CLEARSY

La société CLEARSY

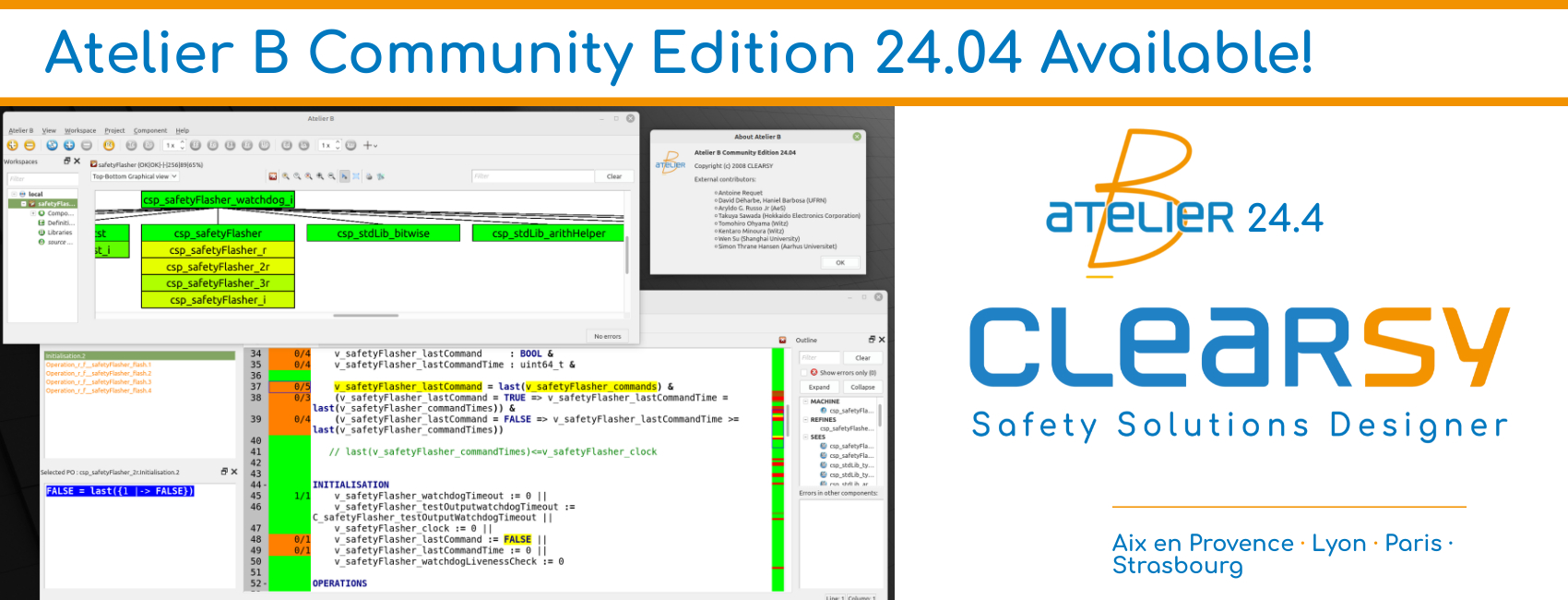

CLEARSY a été fondée le 1er Janvier 2001 par l’équipe d’ingénieurs auteurs de l’industrialisation de l’outil de modélisation formelle nommé Atelier B, utilisé dans le secteur du ferroviaire pour réaliser les logiciels de sécurité.

CLEARSY : ingénierie de systèmes sécuritaires

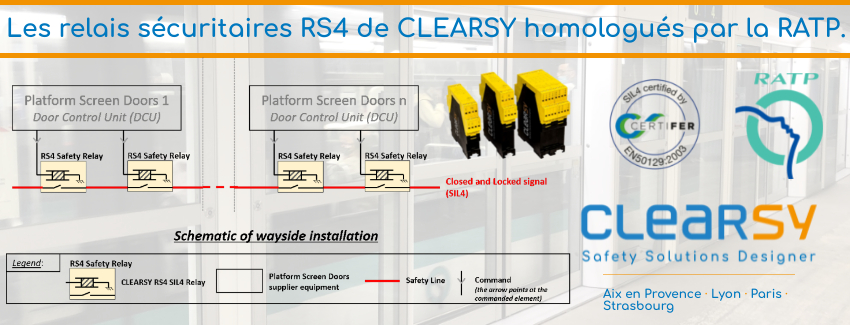

Nous sommes une PME française, spécialisée dans la réalisation de systèmes et de logiciels sécuritaires de niveau SIL1 à SIL4. Nous développons des systèmes complexes en assurant leur conception, jusqu’à leur mise en service, en passant par leur validation, vérification et étude de sécurité.

CLEARSY réalise notamment des systèmes et logiciels sûrs dans les domaines ferroviaire, automobile, militaire, spatial et nucléaire.

Télécharger la brochure

Télécharger

Télécharger la présentation des produits

Télécharger

Télécharger la présentation des produits ferroviaires

Télécharger

Actualités

Logiciels & systèmes sécuritaires

Tous nos systèmes et logiciels sécuritaires disponibles ci-dessous. Vous avez une problématique spécifique, contactez-nous.

systèmes opérationnels